Crypto Has a Merchant Problem, Not a User Problem

The Numbers Expose a Structural Problem in Crypto Payments

Cryptocurrency adoption has reached hundreds of millions of users worldwide. Estimates place global crypto holders between 560 and 700 million. At the same time, fewer than 20,000 merchants globally accept crypto directly.

That gap is not marginal. It represents less than 0.004 percent of global merchants serving a rapidly growing user base.

This mismatch is not the result of slow adoption or temporary friction. Instead, it reflects a deeper structural issue in how the crypto industry approached payments from the beginning.

Crypto did not fail at payments. The industry failed to understand how payments actually work.

The Original Assumption That Shaped Crypto Payments

Early crypto payment strategies were built on a single assumption.

If crypto payments became easy enough, merchants would adopt them.

As a result, the industry invested heavily in merchant-side tooling:

- checkout plugins

- payment buttons

- point-of-sale integrations

- crypto gateways

- “accept crypto” campaigns

The expectation was that merchants would adapt their systems, accounting, and risk models to accommodate crypto.

However, this assumption ignored a critical reality. Merchants already operate stable, regulated, and optimized financial systems. Asking them to replace or reconfigure those systems introduced friction, not value.

Why Merchants Rationally Avoid Direct Crypto Acceptance

Merchants are not resistant to innovation. They are resistant to operational risk.

- From a merchant perspective, direct crypto acceptance introduces challenges that outweigh the perceived benefits:

- revenue volatility

- balance sheet exposure

- wallet management and key security

- tax and accounting complexity

- regulatory uncertainty

- reconciliation issues

In contrast, merchants prioritize:

- fiat certainty

- predictable settlement

- established banking rails

- familiar accounting processes

- compliance clarity

- minimal operational disruption

These preferences are rational. Ignoring them created an adoption strategy that placed complexity on the side least willing to absorb it.

Where Crypto Payments Went Wrong

Crypto payment infrastructure was largely built backward.

Instead of adapting crypto to the existing payment environment, the industry attempted to convert merchants into crypto operators. This approach placed the burden of adoption on businesses that had no incentive to change.

As a result, adoption stalled.

Crypto holders adapted quickly. Merchants did not.

The gap between the two grew wider each year, creating what is now commonly referred to as the crypto usability problem.

Why Merchant Acceptance Is the Wrong Battle

The fundamental question was never how to make merchants accept crypto.

The correct question is how to let crypto fund real-world payments without requiring merchants to change anything at all.

In traditional finance, payments succeed because the funding source is abstracted away from the settlement experience. Card networks, bank transfers, and clearing systems operate behind the scenes. Merchants receive fiat. They do not manage the funding layer.

Crypto attempted to invert this model.

That inversion failed.

The Missing Layer: Settlement, Not Acceptance

What crypto lacked was a settlement-layer solution.

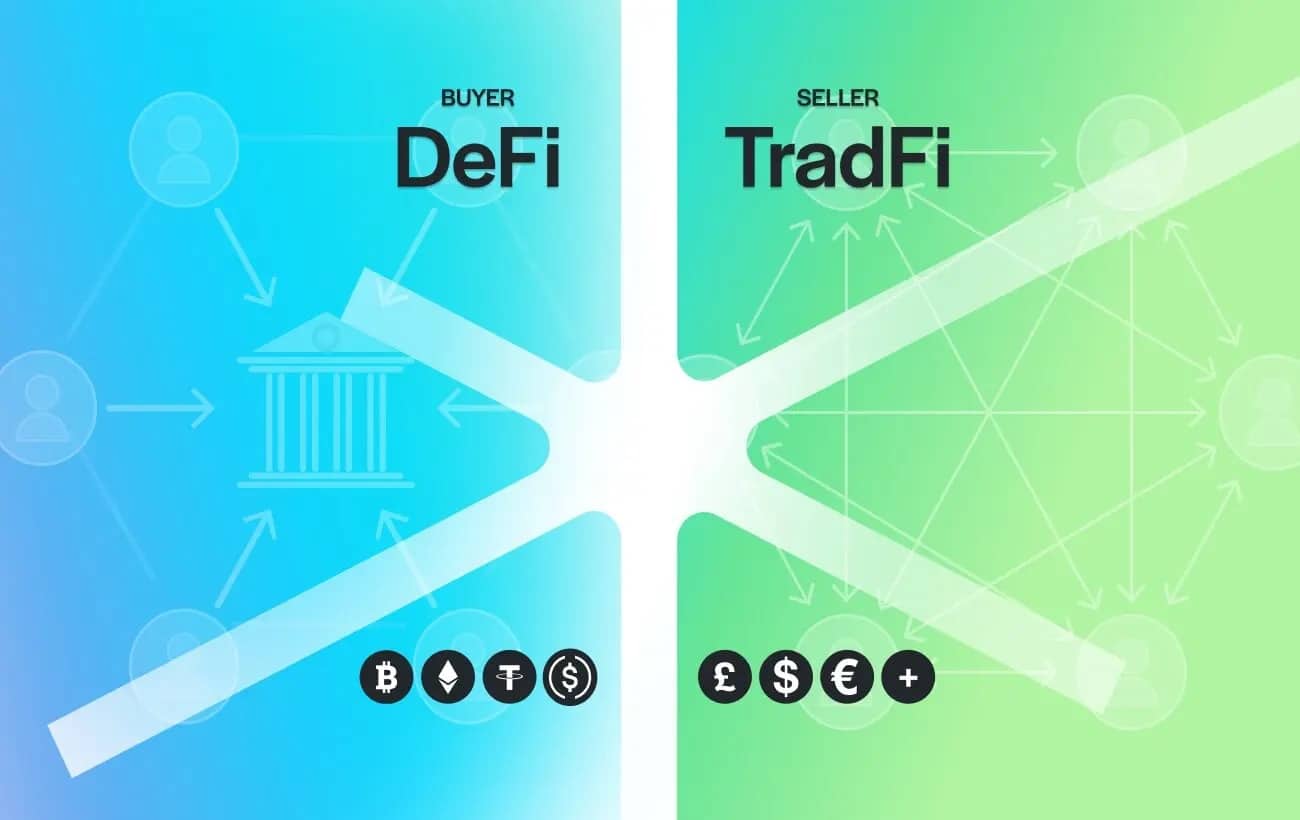

- A settlement-layer model separates funding from settlement:

- crypto is used by the payer

- fiat is received by the merchant

- banking rails remain unchanged

- accounting and compliance remain intact

In this model, merchants do not “accept crypto.” They receive standard fiat transfers. The complexity stays on the payer side, where crypto is already native.

This approach aligns crypto with how payments function in the real world.

How Crypto Can Scale Without Converting Merchants

When crypto funds fiat settlement instead of replacing it, several things change:

- merchants remain fiat-native

- accounting workflows stay untouched

- regulatory clarity improves

- adoption scales without friction

- coverage becomes universal

Instead of onboarding merchants one by one, every business that accepts a bank transfer becomes reachable.

This is the point at which crypto stops competing with existing systems and starts complementing them.

Where This Model Exists Today

This settlement-layer approach already exists in regulated form.

Platforms such as TrustLinq are built on this principle. Crypto remains non-custodial on the user side. Fiat settlement occurs through regulated banking rails. Merchants receive standard bank transfers without ever touching crypto.

There are no integrations, no wallets, and no balance sheet exposure on the merchant side.

This is not a workaround. It is infrastructure.

Why This Shift Matters for Adoption

Crypto’s first decade focused on survival and experimentation. The next phase depends on usability and scale.

That transition requires meeting the real world where it already operates.

Payments scale when they respect existing systems. Crypto adoption accelerates when users gain utility without forcing others to adapt.

This is not about abandoning decentralization. It is about applying it intelligently.

Connect, Do Not Convert

Crypto does not need merchants to convert.

It needs to connect.

When crypto functions as a funding layer and fiat remains the settlement layer, adoption becomes a technical problem rather than a behavioral one.

That is how payments scale.

FAQs

Most merchants avoid crypto because it introduces volatility, accounting complexity, and regulatory uncertainty. They prefer predictable fiat settlement through existing banking rails.

No. Crypto failed at merchant-side adoption, not at payments themselves. The issue was forcing merchants to change, instead of adapting crypto to existing payment systems.

The biggest problem is the gap between crypto funding and fiat settlement. Most real-world payments still require bank transfers, while crypto tools focus on merchant acceptance.

Crypto can fund fiat payments through a settlement layer. In this model, the payer uses crypto while the merchant receives a standard bank transfer.

No. Mass adoption depends on settlement, not acceptance. When crypto funds fiat payments invisibly, every merchant becomes reachable without changing their systems.

Turn Crypto Into Real World Payments

Use stablecoins to pay any bank account worldwide through a Swiss-regulated framework.

Spend crypto without waiting for merchant adoption.

→ Start spending crypto as individual

→ Use crypto for your business