Crypto Transfers Are Being Flagged More Than Ever

In 2026, crypto-related bank transfers are being delayed, reviewed, or frozen more frequently than ever before. This affects private individuals, business owners, and long-term crypto holders alike, even when funds are legal and properly declared. The underlying issue is not crypto itself. It is how crypto-linked value enters the traditional banking system and how that movement is interpreted by modern compliance infrastructure.

Banks now rely heavily on automated risk scoring systems. These systems analyze transaction patterns, payment rails, counterparties, jurisdictions, and intermediary exposure. When crypto funds move into the banking system without a clearly defined structure, those systems default to caution.

Why Banks Freeze Crypto Transfers

Most crypto-related bank freezes are structural rather than punitive. They are triggered when a transaction cannot be clearly categorized or explained within standard banking logic.

Common triggers include:

– transfers from exchanges into personal bank accounts without clear payment purpose

– repeated crypto inflows that resemble income or operational revenue

– cross-border transactions with incomplete compliance metadata

– payments routed through multiple correspondent banks with inconsistent risk policies

Increased global reporting obligations have made banks more conservative. When information is fragmented or ambiguous, the safest action for a bank is to pause the transfer.

The Hidden Risk of SWIFT and Correspondent Banking

Many crypto-to-fiat solutions rely on international SWIFT transfers. These transfers often pass through multiple correspondent banks before reaching the final recipient. Each correspondent bank applies its own compliance rules and risk appetite.

This creates several problems:

– each intermediary bank can independently flag or delay the transfer

– crypto-related transactions face inconsistent interpretation across jurisdictions

– the sender has no visibility into where or why a transfer is stopped

Even if the originating bank approves the transaction, a correspondent bank may still block it. This is one of the most common and least understood causes of frozen crypto-related transfers.

Why Local Clearing and Global ACH Reduce Risk

A more reliable approach is settlement through local clearing rails, such as domestic ACH or equivalent local transfer systems. These rails reduce the number of intermediaries involved in a transaction.

Key advantages include:

– fewer compliance touchpoints

– clearer transaction routing

– better alignment with local banking expectations

– reduced exposure to correspondent bank risk

When a payment settles locally, the receiving bank sees a standard domestic transfer rather than an international crypto-linked wire moving through multiple institutions.

Why Off-Ramping to Yourself Increases Scrutiny

Sending crypto to an exchange and then transferring funds into your own bank account has become the highest risk pattern. When funds land in a personal account, banks must assess whether the activity represents income, business operations, or unexplained inflows.

This forces banks to evaluate:

– source of funds

– frequency and size of transactions

– economic purpose

– account behavior consistency

Even compliant users can face reviews because the structure creates unnecessary ambiguity.

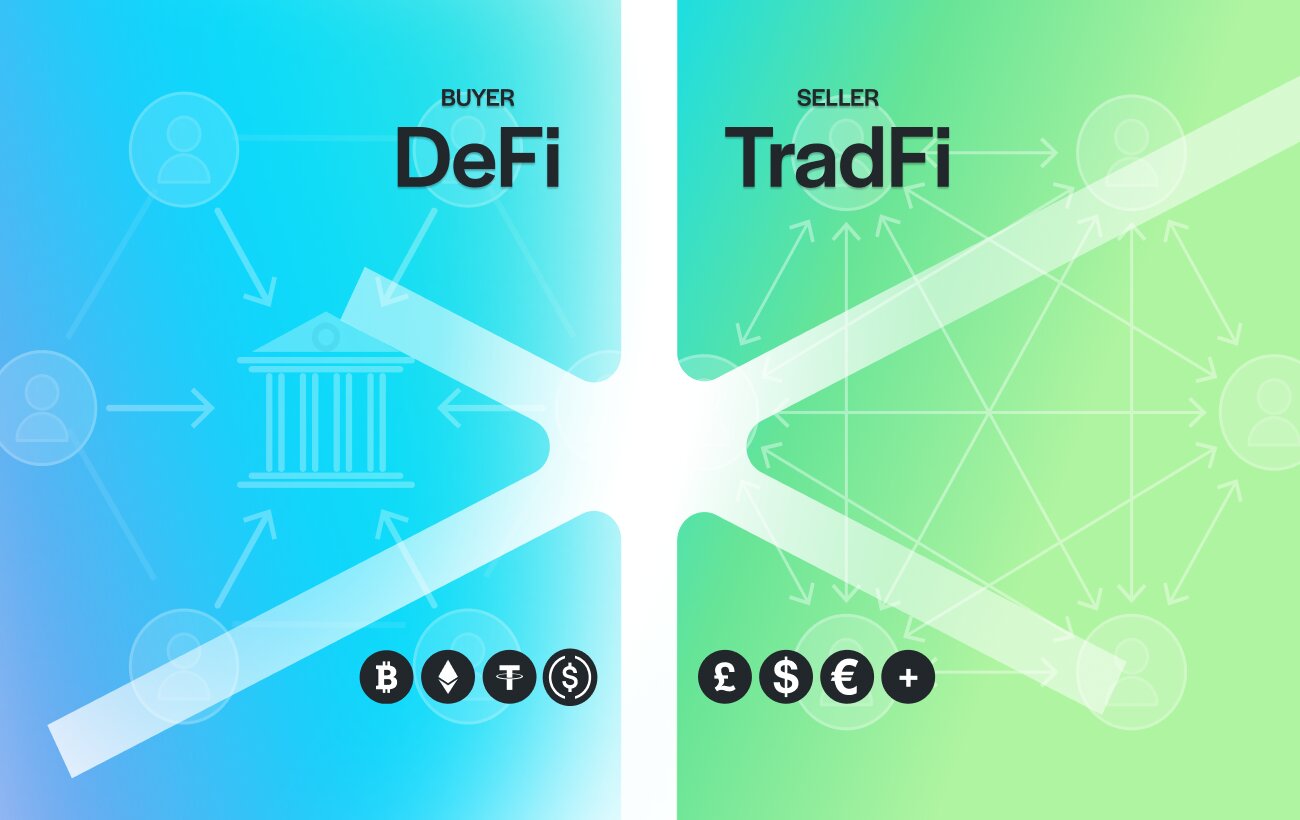

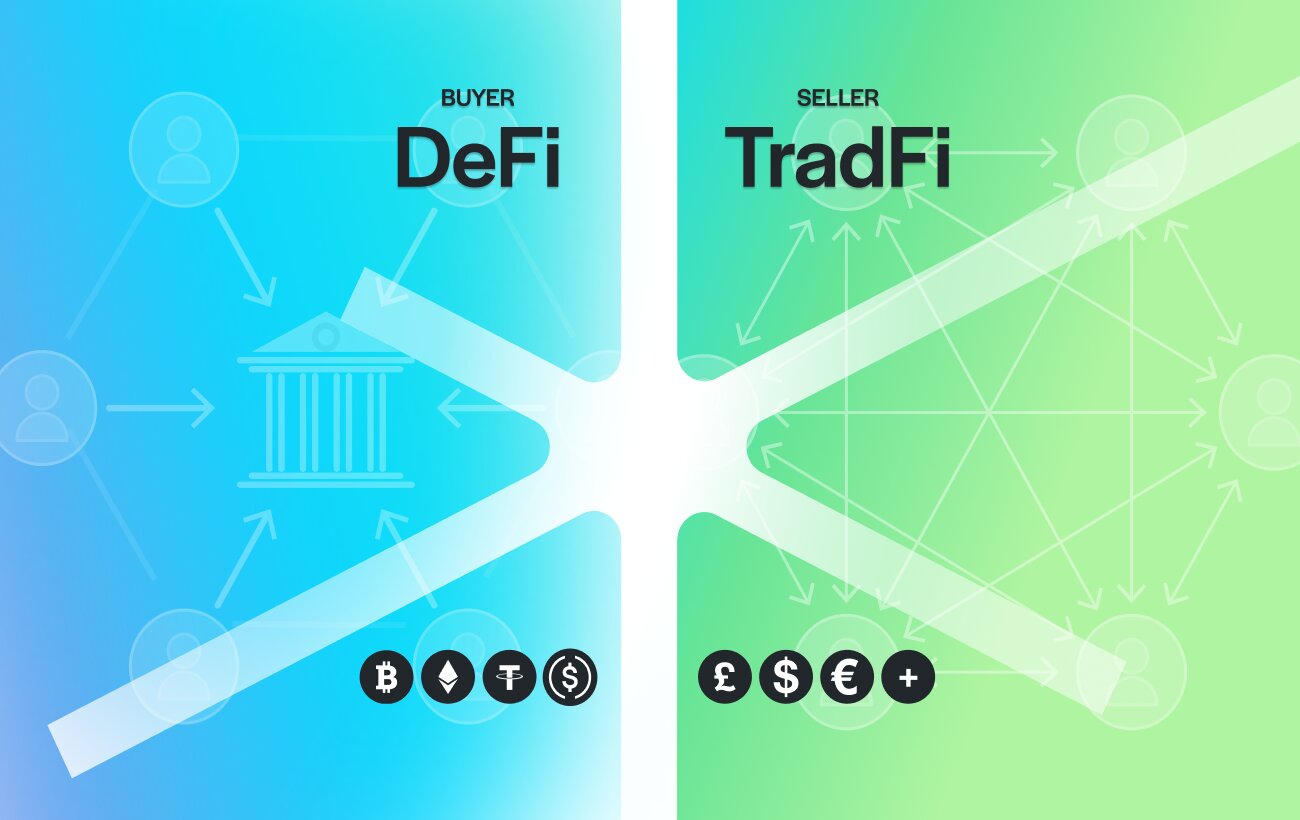

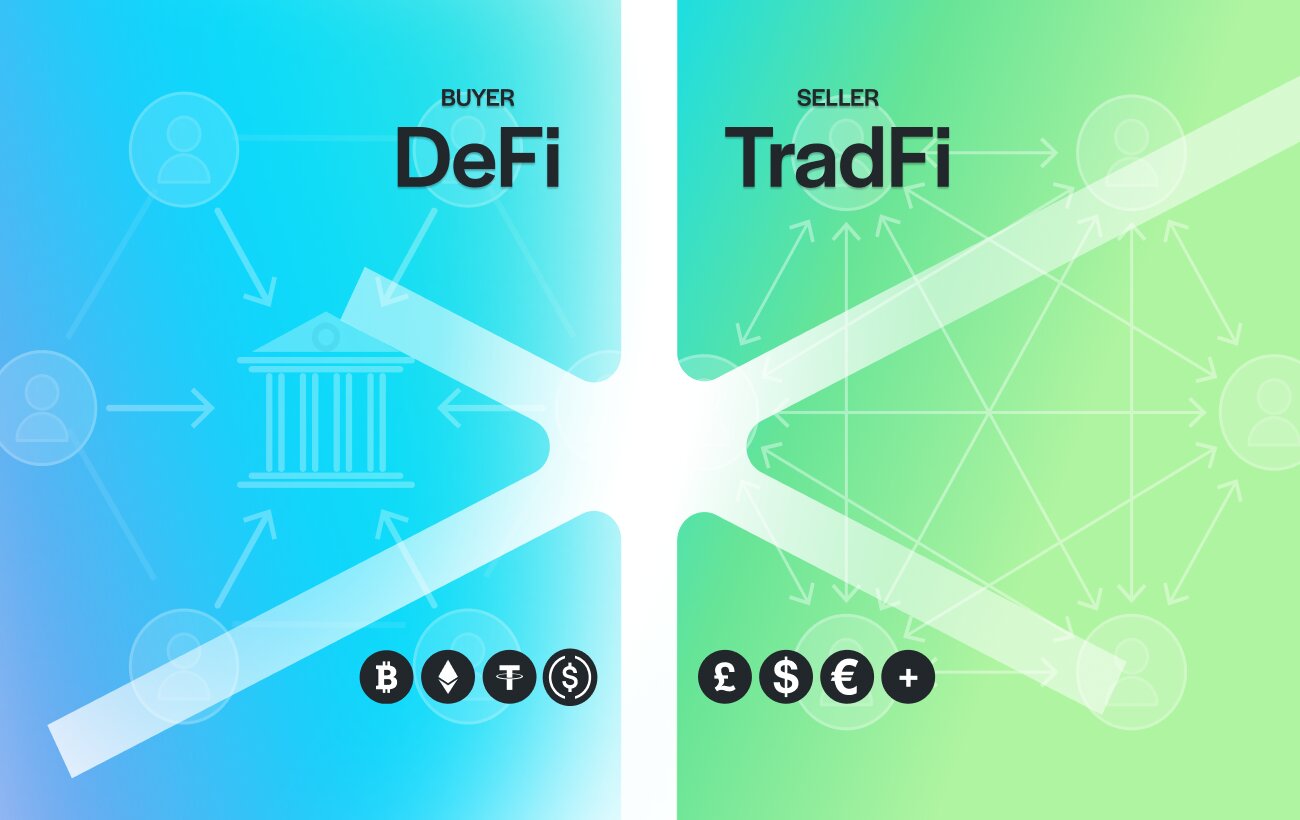

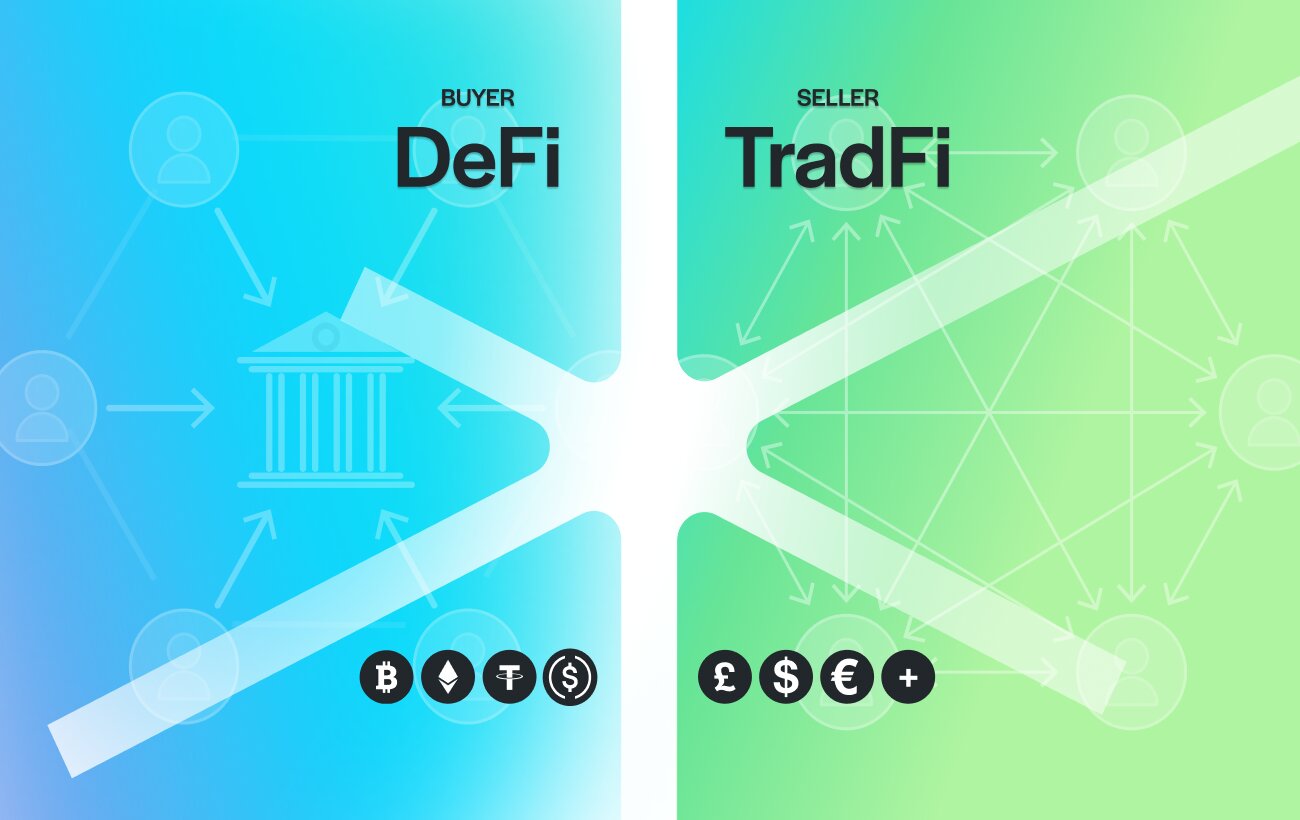

Crypto-Funded Fiat Settlement as a Professional Alternative

Crypto-funded fiat settlement separates funding from settlement. Instead of moving crypto into your own account, the crypto funds a payment that settles directly to the final beneficiary in local currency.

This structure offers:

– a clear economic purpose tied to the payment

– local fiat settlement through domestic rails

– no repeated crypto inflows into personal accounts

– compliance screening before funds reach the banking system

By aligning with how banks already process payments, this approach significantly reduces friction.

The Role of Swiss-Regulated Intermediaries

When settlement is handled by a Swiss-regulated financial intermediary, the transaction enters the banking system with prior regulatory screening. This includes transaction monitoring, sanctions checks, and source-of-funds validation.

As a result:

– the receiving bank receives a clean fiat transfer

– the compliance burden is reduced

– the likelihood of freezes or reversals is lower

This does not bypass regulation. It applies it earlier in the transaction flow, where it is most effective.

Who Benefits Most From This Structure

This approach is particularly relevant for:

– high-value crypto spenders

– international buyers and digital nomads

– businesses paying suppliers or contractors

– individuals seeking predictable banking outcomes

In all cases, prevention matters more than resolution. Once a bank freeze occurs, timelines and outcomes are uncertain.

Avoiding Bank Freezes Starts With Structure

Banks do not freeze accounts because they oppose crypto. They freeze accounts when transaction data lacks clarity. In 2026, the safest way to move value from crypto into the real economy is not through personal off-ramps or international wires. It is through structured settlement that uses regulated intermediaries and local payment rails.

When fewer banks are involved, fewer questions are asked.

FAQs

Banks freeze crypto transfers when automated compliance systems cannot clearly identify the transaction’s source, purpose, or structure within regulatory expectations.

In most cases, no. A freeze usually reflects a compliance review rather than a legal issue.

SWIFT transfers pass through multiple correspondent banks, each with different risk policies, increasing the chance of delays or blocks.

It is a payment structure where crypto funds a transaction while the recipient receives local fiat directly, without funds passing through the sender’s bank account.

Yes. Local clearing systems reduce intermediaries and improve alignment with domestic banking compliance frameworks.

TrustLinq reduces risk by settling payments through local clearing systems rather than relying on international SWIFT transfers. Many crypto-related freezes occur when payments pass through multiple correspondent banks, each applying its own compliance rules. This increases the chance that a transfer is delayed or flagged mid-route.

By using global ACH and domestic transfer rails in the recipient’s country, transactions are settled locally. This limits the number of intermediaries involved, provides clearer transaction context, and aligns better with how receiving banks process standard fiat payments. As a result, transfers are less exposed to correspondent bank scrutiny and more predictable in outcome.

Turn Crypto Into Real World Payments

Use stablecoins to pay any bank account worldwide through a Swiss-regulated framework.

Spend crypto without waiting for merchant adoption.

→ Start spending crypto as individual

→ Use crypto for your business