TrustLinq has officially joined the Circle Alliance Program, a global ecosystem of innovators building purpose-built infrastructure around USDC and EURC. This partnership highlights our shared vision: digital dollars should move with the speed of the internet while maintaining the legal certainty of the traditional financial system.

Bridging the Global Utility Gap

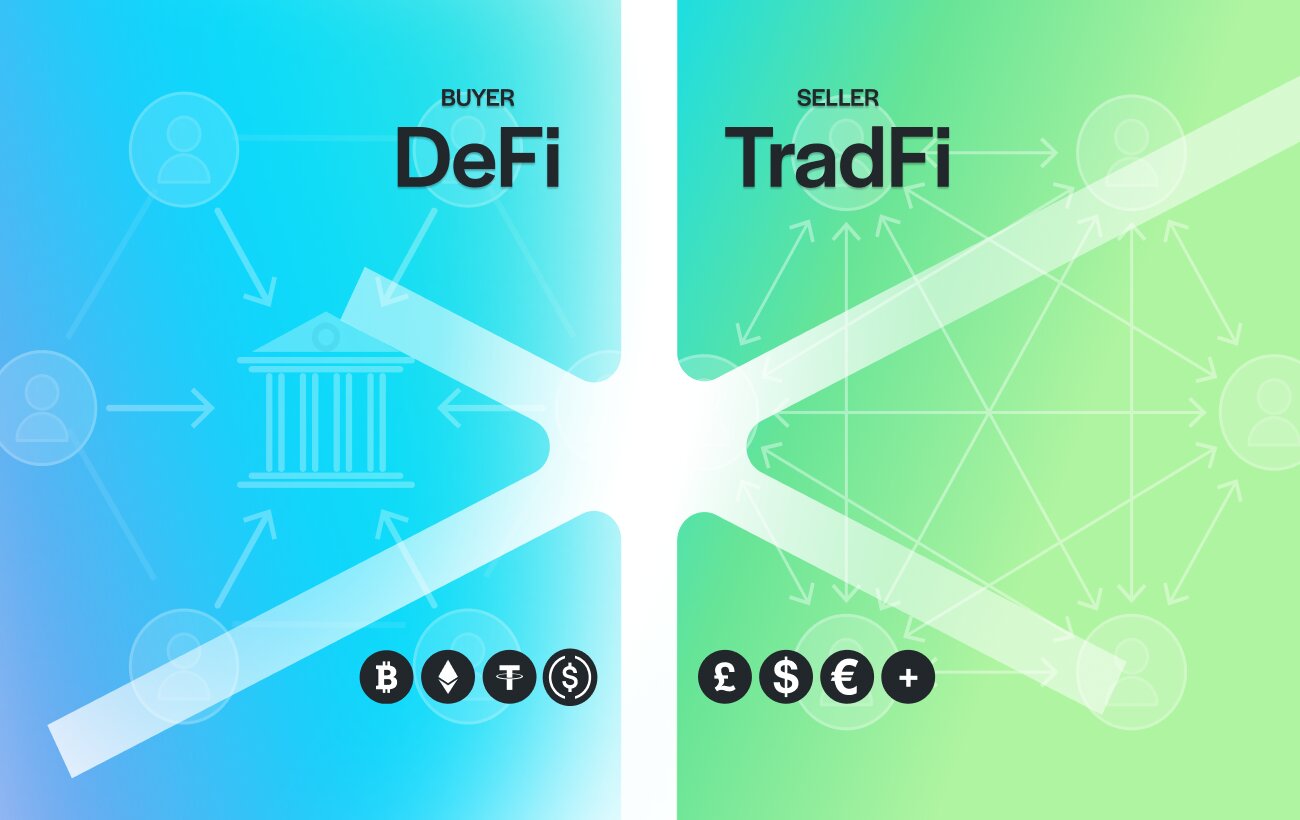

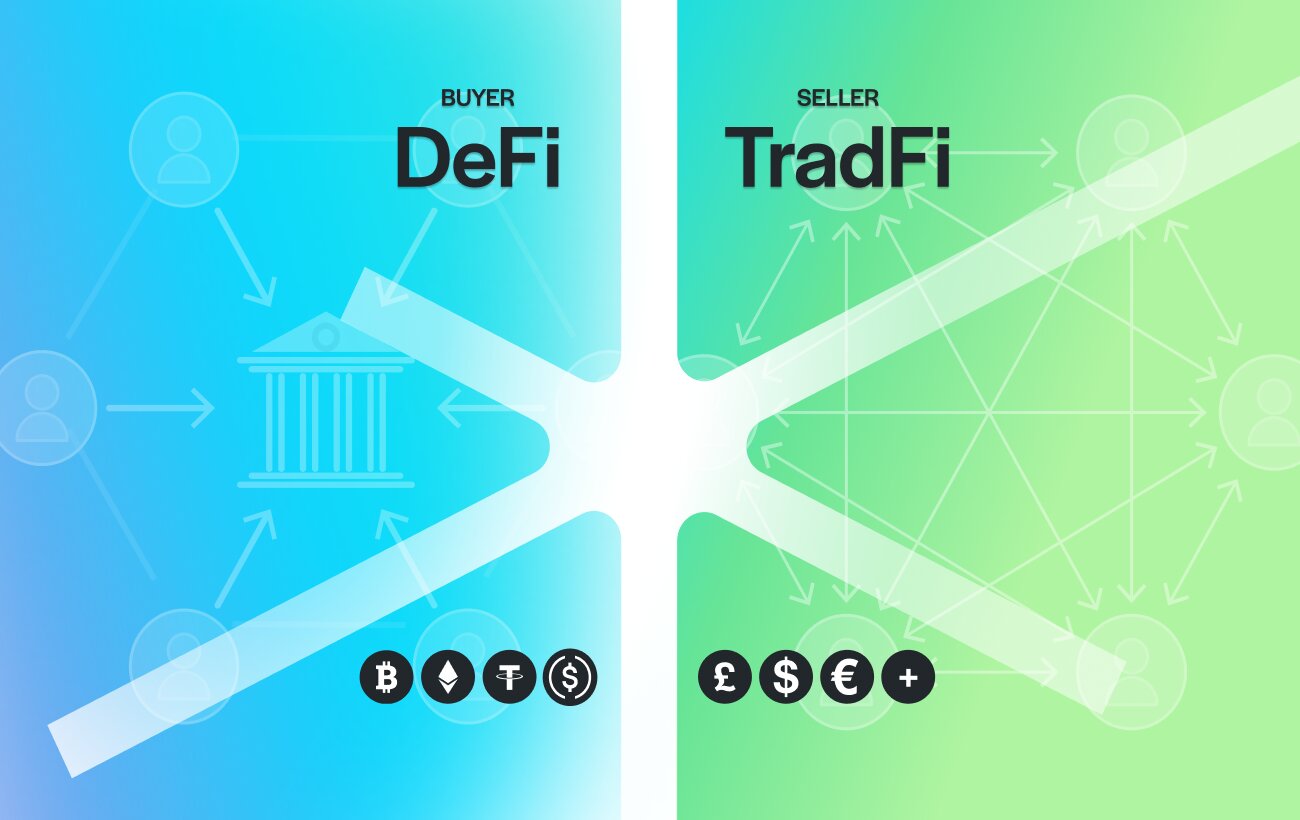

Despite the explosive growth of digital assets, a massive “usability gap” remains. Most of the world’s $27.6 trillion in annual stablecoin transfers currently stay within on-chain ecosystems. Meanwhile, the “Real Economy”, landlords, universities, and global suppliers, still operates entirely on traditional fiat banking rails.

TrustLinq addresses this gap by enabling self-custodial crypto-to-third-party fiat payments. This means individuals and businesses can fund their largest real-world expenses using stablecoins directly from their own wallets, while recipients receive local fiat currency (USD, EUR, GBP) via SEPA, Faster Payment, ACH, Global ACH or SWIFT.

- The Infrastructure Advantage: The sender does not need a bank account, and the recipient does not need to accept crypto.

- Just-In-Time Liquidity: Funds are bridged at the moment of payment, reducing the need for idle cash buffers in multiple currencies.

- Compliant Movement: Every settlement is processed under Swiss regulation, ensuring bank-level security for every transaction.

Moving Beyond “Crypto Acceptance”

Today, more than 580 million companies and individuals hold cryptocurrency however, less than 0.003% of global businesses accept cryptocurrency directly. This is not due to a lack of interest, but because traditional accounting, tax, and operational systems are deeply embedded in fiat rails.

Rather than waiting for every business in the world to “accept crypto,” TrustLinq enables stablecoins to work within existing financial workflows.

- For Global Payouts: Marketplaces and gig platforms can use USDC and EURC to fund thousands of small-value payments daily, which settle locally in fiat.

- For B2B Settlement: Companies can settle international invoices in seconds without waiting for correspondent banking hours or time zone alignments.

- For Individuals: High-net-worth individuals and digital nomads can secure housing or luxury assets without the administrative friction of opening local bank accounts.

A New Category in the Internet Economy

Circle’s infrastructure has become the foundational layer for a new “Economic OS” for the internet. Being listed in the Circle Alliance places TrustLinq alongside the leaders building programmable compliance and global operability.

The future of finance is not a parallel system; it is a unified one where tokenized assets and traditional commerce interact seamlessly. TrustLinq’s inclusion in the Alliance reinforces our role in this evolution—transforming stablecoins from speculative assets into the internet’s primary dollar for real-world settlement.

FAQs

The Circle Alliance is a network of companies building regulated infrastructure around Circle’s stablecoins, USDC and EURC. TrustLinq joined to align its Swiss-regulated bridge with the world’s most trusted digital dollar, ensuring that our users have access to highly liquid, fully reserved assets for their real-world payments.

es. Through our integration with global payout networks and Circle’s infrastructure, you can send USDC or EURC to fund a bank transfer to any recipient worldwide. The recipient receives fiat directly in their bank account via standard rails like SEPA or Global ACH, even if they do not have a crypto wallet.

Traditional cross-border bank transfers often take 3–5 days due to batch processing and time zone delays. By using Circle’s always-on infrastructure, TrustLinq enables near-instant settlement 24/7/365, bypassing banking hours and traditional “correspondent” banking layers.

Security is the cornerstone of this partnership. Circle’s stablecoins are backed 100% by highly liquid cash and equivalents and are subject to rigorous risk management. TrustLinq adds a layer of Swiss-regulated oversight, ensuring every “bridge” from crypto to fiat meets global AML and KYC standards for a clean, bank-verified audit trail.

Ready to use your crypto for real-world payments?

You can register once and choose whether you are signing up as an individual or a company.