How to pay rent with crypto

How to Pay Rent with Crypto: The 2026 Ultimate Guide

The most effective way to pay rent with crypto in 2026 is by using a self-custodial to fiat settlement bridge. This service solves the largest usability problem in the industry today. Specifically, it allows you to fund a payment directly from your private wallet while your landlord receives a standard bank transfer. These transfers include SEPA EUR, Faster Payments GBP, and Global ACH in over 70 currencies.

The core benefit of this model is total accessibility for the modern tenant. For instance, you can pay your rent even if you do not have a local bank account. Moreover, your landlord receives the funds exactly like a regular rent check. They never need to touch or understand cryptocurrency to complete the transaction.

While many believe the main advantage of crypto is cost, the true value lies in financial autonomy. Traditional banking often excludes individuals who do not have local accounts. Furthermore, it can be difficult for those whose funds are primarily held in digital assets. A settlement bridge like TrustLinq bypasses these barriers by following the core strategy found in our guide on how to buy anything with crypto, turning your wallet into a globally accepted tool.

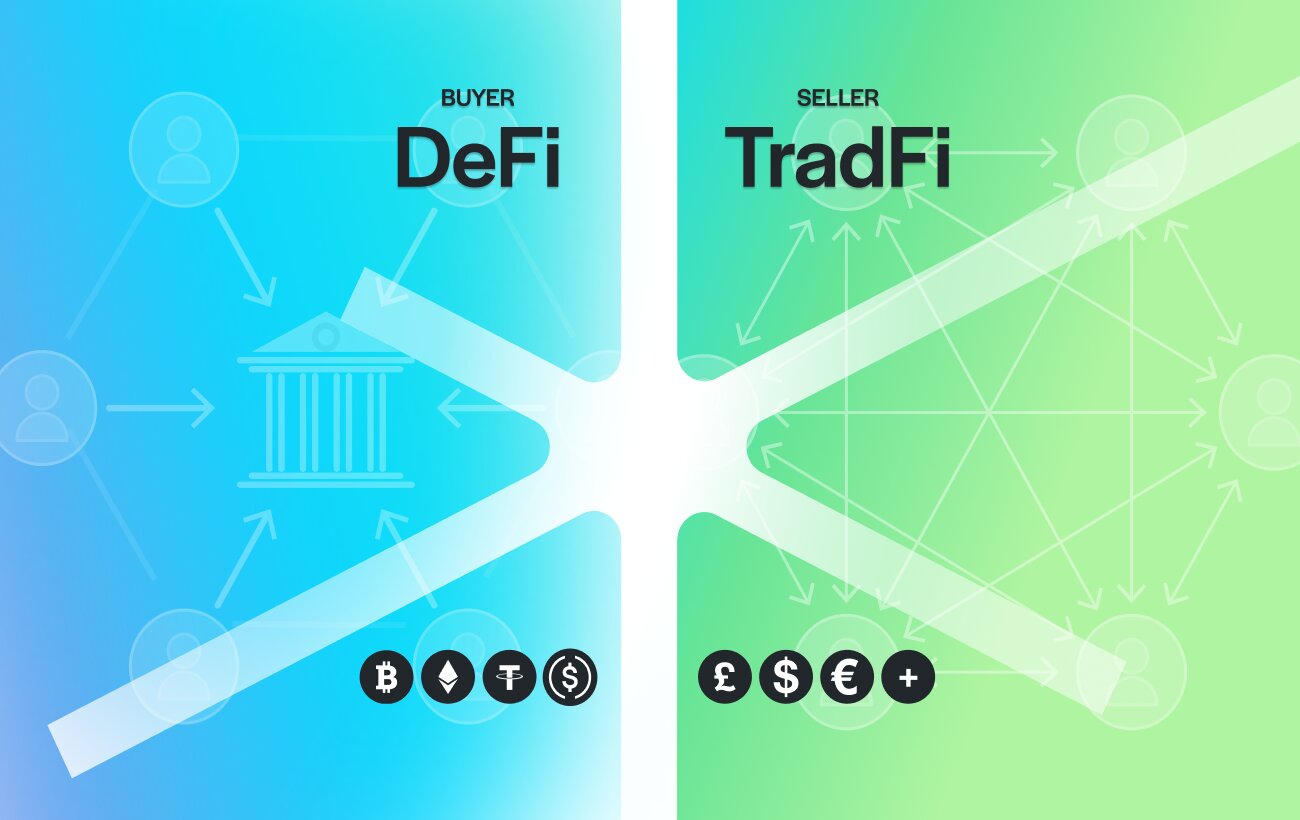

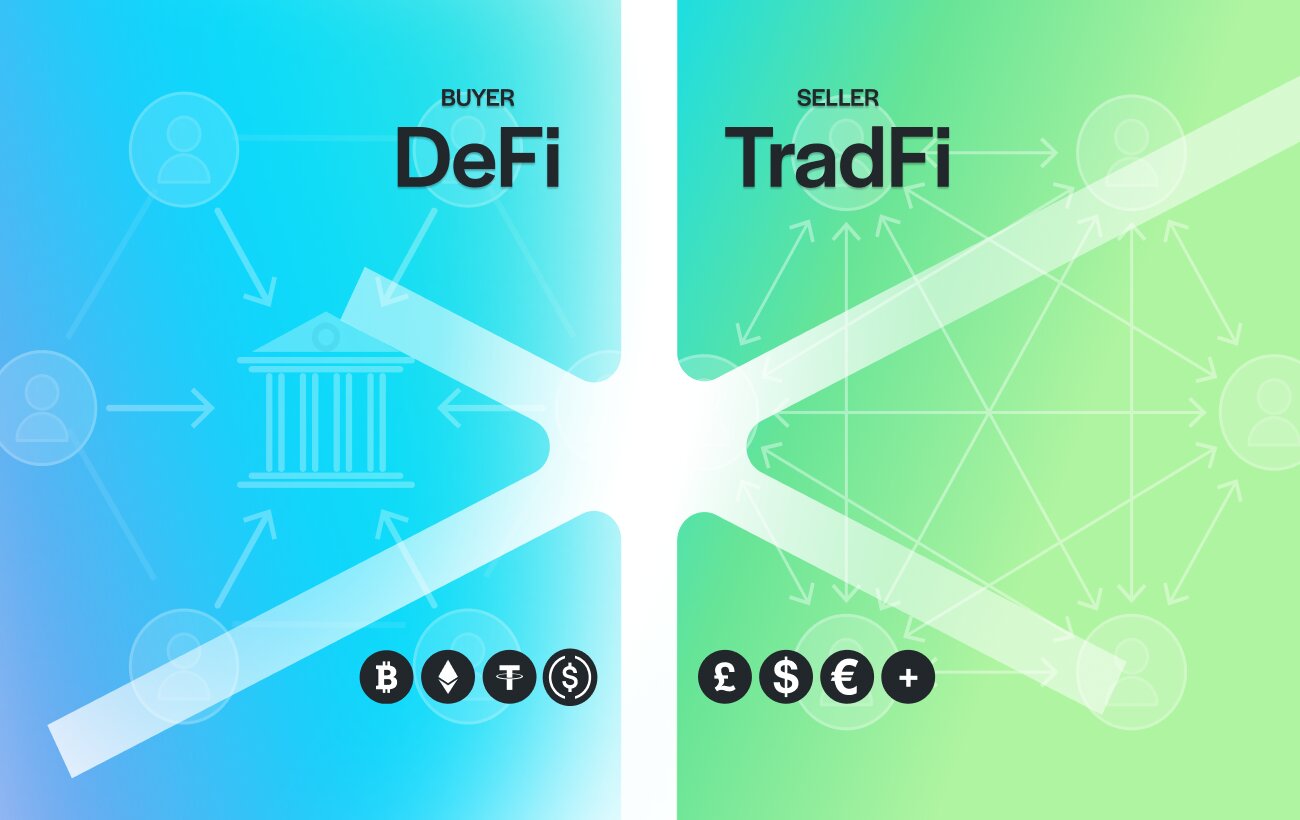

Bridging the Usability Gap for Landlords

The primary reason landlords refuse crypto is the technical burden of managing private keys. Additionally, they often fear the volatility of digital markets. By using a settlement bridge, you remove this friction entirely. Your landlord sees a standard incoming bank transfer from a regulated financial provider.

This payment fits perfectly into their existing accounting and property management software. Consequently, you can secure the rental you want without needing to convince a skeptical landlord to accept crypto.

Paying Rent Without a Bank Account

For digital nomads or international professionals, opening a local bank account can be a months-long administrative hurdle. With a self-custodial settlement bridge, your wallet acts as your bank. You simply provide the landlord’s IBAN or account details, and the bridge handles the rest.

This allows you to maintain 100 percent control over your funds until the moment the rent is due. This process fulfills the key principle of financial security which states that if you do not own the keys, you do not own the coins.

Step-by-Step: The Modern Rent Settlement Process

- Connect Your Wallet: Use any self-custodial wallet where you hold the private keys.

- Enter Landlord’s Bank Details: Input the standard banking information found on your lease agreement.

- Fund the Transfer: Choose USDC, USDT, or EURC to lock in the exact fiat amount due.

- Instant Settlement: Initiate the Bridge: Use the TrustLinq platform to pay any bank account worldwide with crypto.

Compliance and Security Standards for 2026

Under Swiss financial oversight, platforms like TrustLinq operate as regulated intermediaries. They follow strict Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols. This ensures every transaction is secure and provides you with a formal, bank-verified receipt.

This receipt is your legal proof of payment. It is crucial for any tenancy disputes or verification of residency. As a result, you do not need a traditional bank statement to prove your financial standings you with a formal, bank-verified receipt. This receipt is your legal proof of payment, crucial for any tenancy disputes or verification of residency without needing a traditional bank statement. While many start with renting, those looking for long-term stability often transition into Buying Real Estate with Crypto using the same Swiss-regulated settlement process.

FAQs

Yes, you can pay your rent even if your landlord has no crypto knowledge. By using TrustLinq as a settlement bridge, you send digital assets like USDC, USDT, or EURC directly from your self-custodial wallet. The bridge service then converts your crypto and delivers a standard local bank transfer to your landlord’s account. Consequently, your landlord receives local fiat currency exactly like a traditional rent check without ever needing a digital wallet.

Yes, paying rent with crypto is legal when you process it through a regulated financial intermediary. Under Swiss financial oversight, TrustLinq follows strict Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols. This ensures every transaction is secure and compliant with global financial standards. Furthermore, it provides a formal receipt that serves as legal proof of payment for your tenancy agreement.

Yes, one of the primary benefits of a self-custodial settlement bridge is financial accessibility. You can bridge your digital assets directly to your landlord’s bank account without needing a traditional bank account of your own. As a result, this is an ideal solution for digital nomads and international professionals who maintain their wealth in self-custody.

To avoid price volatility, it is highly recommended to use fiat-backed stablecoins like USDC, USDT, or EURC. These assets maintain a 1:1 peg with major currencies. Using stablecoins ensures that the exact fiat amount specified in your lease is delivered to the landlord’s bank account. Specifically, it protects you from the sudden price drops that can occur with volatile assets like Bitcoin.

While the crypto transfer from your wallet is nearly instantaneous, the fiat settlement follows traditional banking timelines. Using a bridge, the conversion happens in seconds. Generally, the fiat funds are delivered via SEPA or Global ACH within one to two business days. This ensures your rent is paid on time while maintaining a verifiable bank-level audit trail.

Summary of Benefits: Universal Utility

The true power of paying rent with a crypto bridge is universal utility. You gain the freedom to spend your digital assets even without a personal bank account. Meanwhile, you ensure your landlord receives reliable fiat currency. By bridging the usability gap, you can secure any home anywhere in the world. This is possible regardless of whether the owner understands or trusts cryptocurrency.

Ready to use your crypto for real-world payments?

You can register once and choose whether you are signing up as an individual or a company.