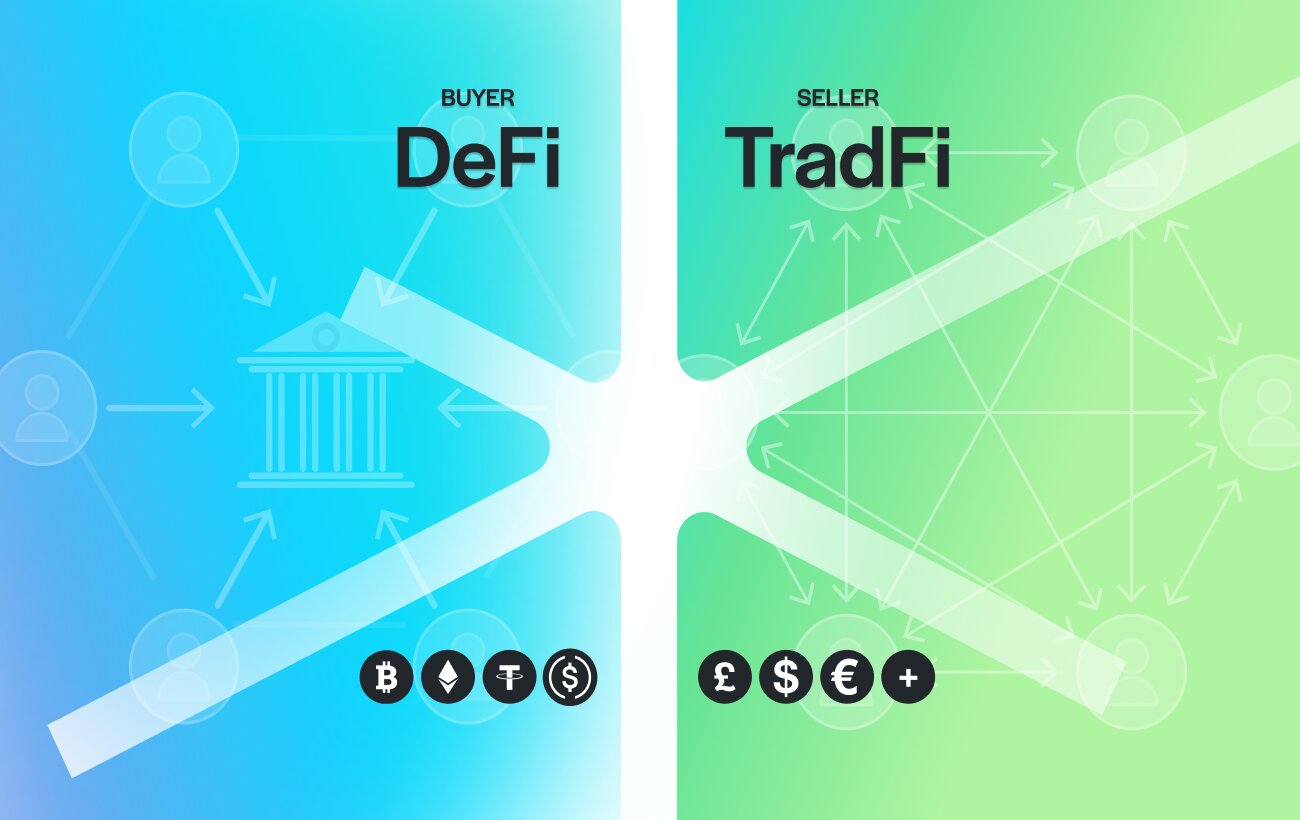

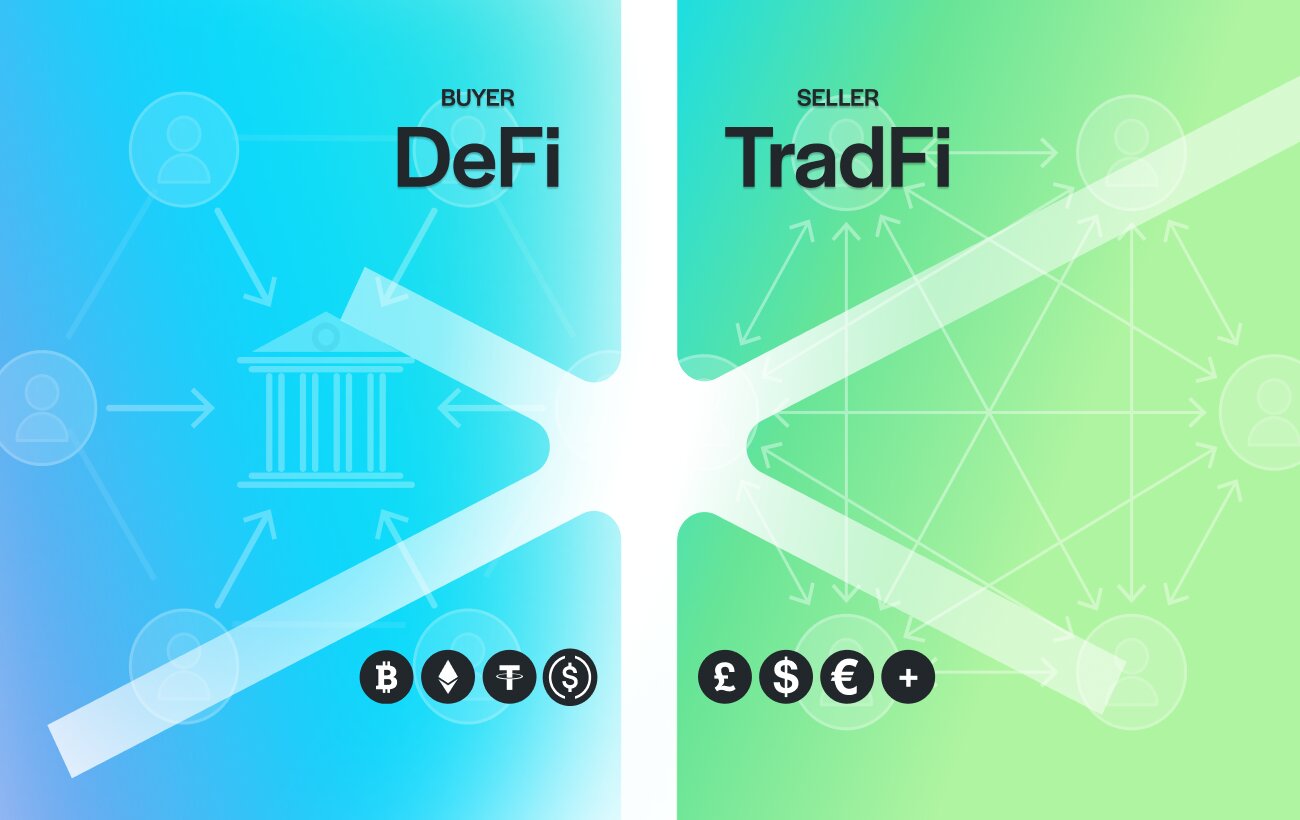

Thousands of companies now hold cryptocurrency on their balance sheets. Yet when it comes to paying suppliers, contractors, or staff, most still face the same obstacle: how to use crypto for business expenses efficiently or use stablecoins for business payments to cover everyday costs without complexity. The truth is that many businesses already explore crypto payments for suppliers, crypto payroll solutions, and other crypto to fiat payment services, but they struggle to find one platform that connects everything securely — as we explained in our earlier post Why Are We Not Using Crypto for Everything Yet

Traditional banking systems were never designed for digital assets. Sending funds to an exchange, converting them, and waiting for clearance creates delays, fees, and compliance friction. With TrustLinq, businesses can pay invoices, salaries, and operating costs in fiat directly from their crypto holdings. It is a fully regulated way to use stablecoins for business payments without needing a new bank account or exposure to market volatility.

The Challenge Businesses Face

Many companies that hold crypto encounter roadblocks when trying to spend it. Banks are cautious about incoming funds from exchanges. Accounting systems often cannot record digital transactions. Compliance teams worry about how to justify or trace conversions. As a result, businesses that could benefit from crypto payroll solutions or crypto payments for suppliers end up reverting to outdated methods.

The disconnect between how companies earn and how they spend leaves capital idle. While invoices pile up, valuable liquidity sits unused in wallets.

How to Use Crypto for Business Expenses

Using crypto for business does not mean abandoning traditional finance; it means bridging the two worlds. TrustLinq allows you to convert crypto to fiat seamlessly and send payments globally.

Here is how it works. Your company holds assets like USDT or USDC. You share payment instructions for a supplier, freelancer, or employee. TrustLinq converts your crypto to fiat instantly and issues a standard SEPA, SWIFT, or Faster Payments transfer. The recipient receives fiat, not crypto.

This system is ideal for crypto payments for suppliers and crypto to fiat payment services that require speed, compliance, and accuracy. You can pay staff, contractors, or vendors anywhere in the world without touching exchanges or worrying about banking restrictions. Ready to simplify your crypto payments? Sign up for early access on TrustLinq.com

If you want to understand the off-ramp process before applying it to your business, read our guide on How to Off-Ramp Crypto Safely and What to Do Instead

Why Businesses Choose TrustLinq

Businesses choose TrustLinq because it turns complex processes into simple workflows.

- Instant settlement in more than seventy currencies.

- Fully compliant under Swiss AML supervision through SO-FIT.

- Transparent reporting suitable for audits.

- No need for a personal or corporate bank account.

- Support for recurring crypto payroll solutions and supplier payments.

Finance teams gain operational flexibility and preserve compliance. TrustLinq provides the infrastructure that allows companies to convert crypto to fiat for business with confidence.

Real-World Use Cases

A technology startup paying international developers can manage all crypto payroll solutions through TrustLinq while staff receive salaries in fiat.

A trading firm using stablecoins for liquidity can now use stablecoins for business payments such as rent or equipment.

A marketing agency that earns income in crypto can easily pay suppliers with crypto converted automatically to fiat.

Any business holding digital assets can now operate globally without needing to move funds through exchanges or handle conversions manually.

Compliance and Transparency

TrustLinq operates under Swiss AML supervision, combining automation with manual oversight for every transaction. This ensures that all crypto to fiat payment services remain transparent, traceable, and fully compliant with financial regulations. The result is a seamless experience where payments are accepted by banks worldwide while remaining fully secure for businesses.

Why This Matters for Businesses

Crypto was once viewed as an investment, but it is now becoming a usable asset class. With TrustLinq, companies can leverage crypto payroll solutions, crypto payments for suppliers, and stablecoin business transactions as part of daily operations. This reduces conversion risk, accelerates payments, and strengthens liquidity management.

Businesses that integrate crypto today are preparing for a future where digital and traditional finance work together.

The Bottom Line

Crypto in, fiat out, instantly.

No exchanges, no waiting, no extra steps.

TrustLinq gives companies a simple, compliant way to pay staff, vendors, and partners worldwide. It is time to turn crypto holdings into real business capability.

Frequently Asked Questions

Yes. TrustLinq converts your crypto into fiat at the time of payment and transfers the amount directly to the recipient’s bank account.

Yes. TrustLinq operates under Swiss AML supervision through the Swiss regulated framework and complies with all regulatory standards.

No. They receive fiat through a regular bank transfer while you pay from crypto

More than seventy currencies through SEPA, SWIFT, FasterPayments and alternative payment methods.

Yes. TrustLinq supports recurring or one-time payments for business use.

No. Payments can range from small operational costs to large supplier invoices.

Ready to use your crypto for real-world payments?

You can register once and choose whether you are signing up as an individual or a company.