Crypto Promised a Revolution – So Why Can’t We Pay for Everything Yet?

For more than a decade, cryptocurrency has been hailed as the future of finance.

Today, hundreds of millions of users hold digital assets and wonder why we don’t use crypto for everything yet.

Still, fewer than 0.5% of businesses globally accept it as payment.

So, what’s stopping mass adoption?

If crypto is global, instant, and efficient, why do we still rely on traditional bank transfers for nearly every transaction?

The short answer: the world hasn’t caught up.

The longer answer combines business hesitation, outdated infrastructure, and a lack of simple, compliant ways to connect crypto with the real economy.

1. Businesses Don’t Reject Crypto – They Don’t Understand It

For millions of crypto users, blockchain technology is second nature. But for most business owners, especially those running established companies it still feels foreign.

They worry about:

- Complexity: “Will I need to learn wallets and private keys?”

- Volatility: “What if Bitcoin drops 5% before settlement?”

- Regulation: “Is it even legal to accept crypto?”

The truth? Most of those fears are outdated. Accepting crypto today doesn’t require technical know-how or risk which makes it even harder to understand why we don’t use crypto for everything yet.

But perception is powerful. Until businesses realize they can accept crypto payments without ever touching crypto, adoption will remain slow.

2. The System Isn’t Built for It (Yet)

Traditional payment networks are built around banks, not blockchains.

That’s why it’s still easy to pay a supplier with a wire transfer and nearly impossible to do the same directly from a wallet.

Meanwhile, merchants face accounting systems that only handle fiat, bank compliance departments skeptical of crypto inflows, and tax frameworks still written for traditional money. However, the technology is ready, but the infrastructure isn’t.

3. Regulation and Compliance Concerns

Many businesses associate crypto with risk, not because they oppose it, but because they lack clear guidance.

They’ve seen banks close accounts over “crypto exposure.” They’ve read about scams and regulatory crackdowns.

Consequently, until recently there was no fully compliant, regulated framework to safely bridge crypto payments to fiat.

That’s where Switzerland’s regulatory model has quietly changed the game.

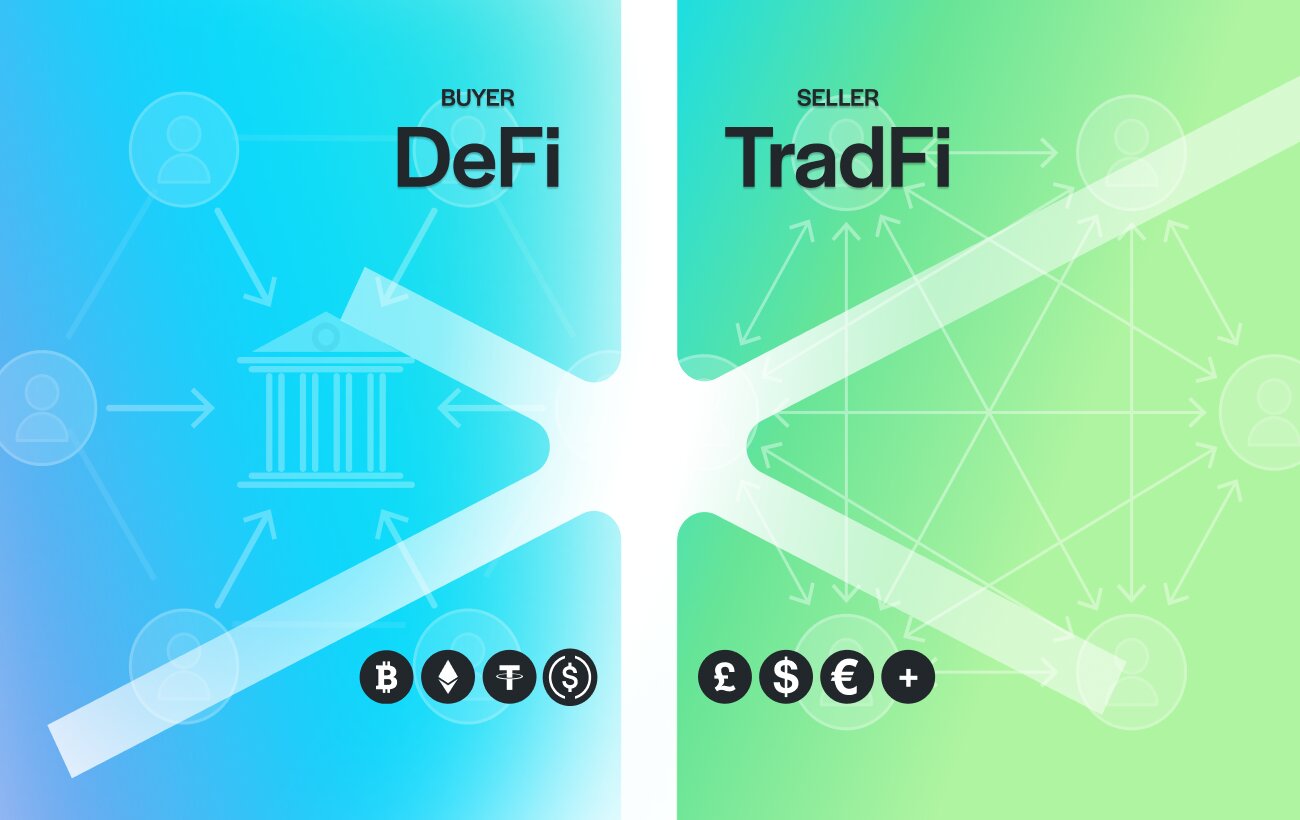

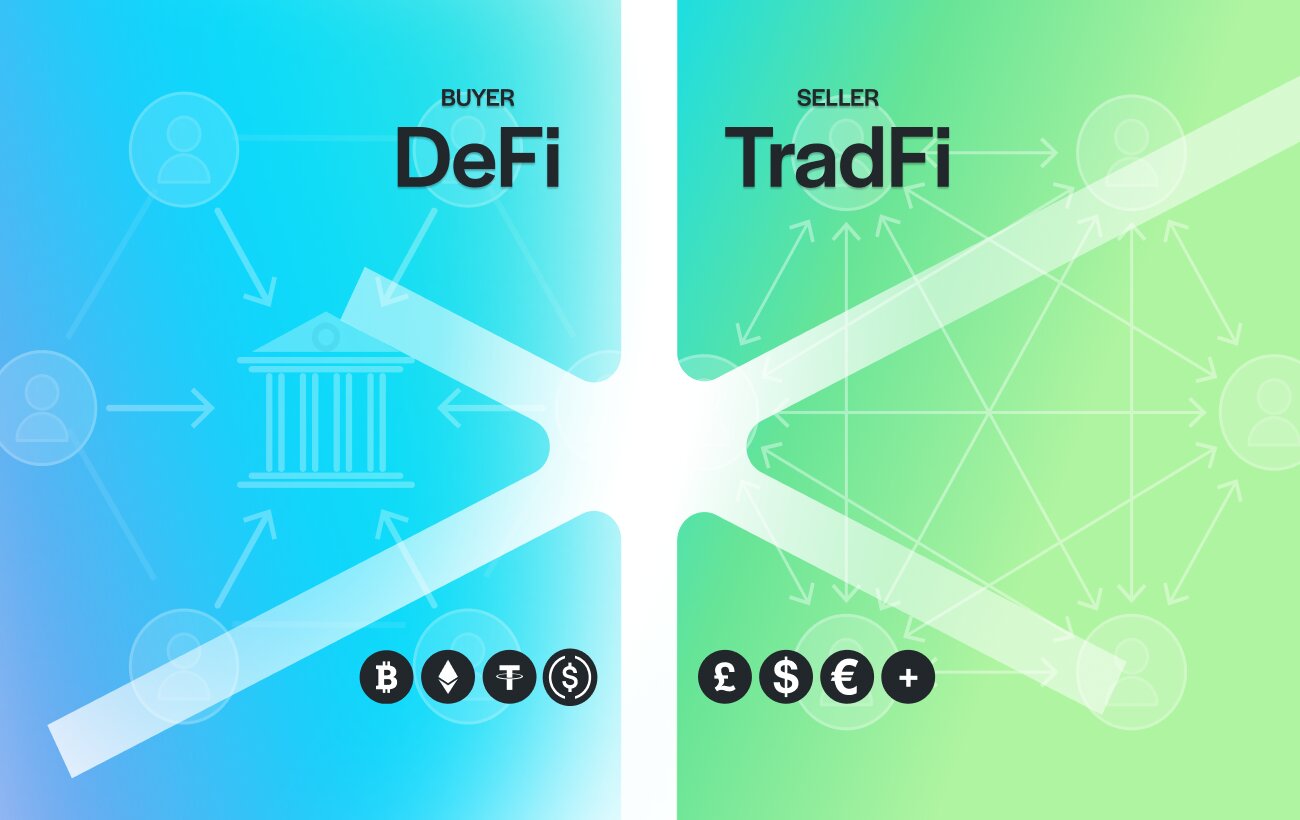

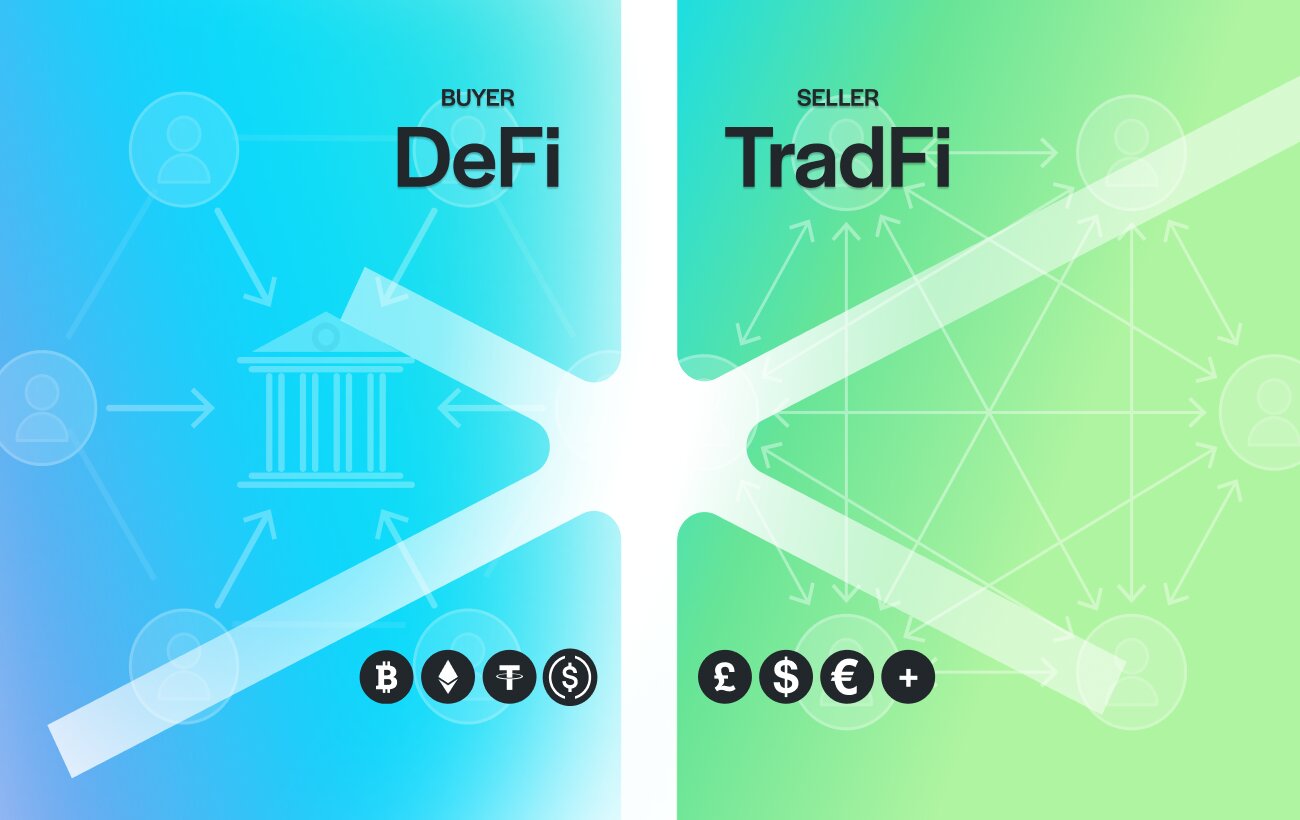

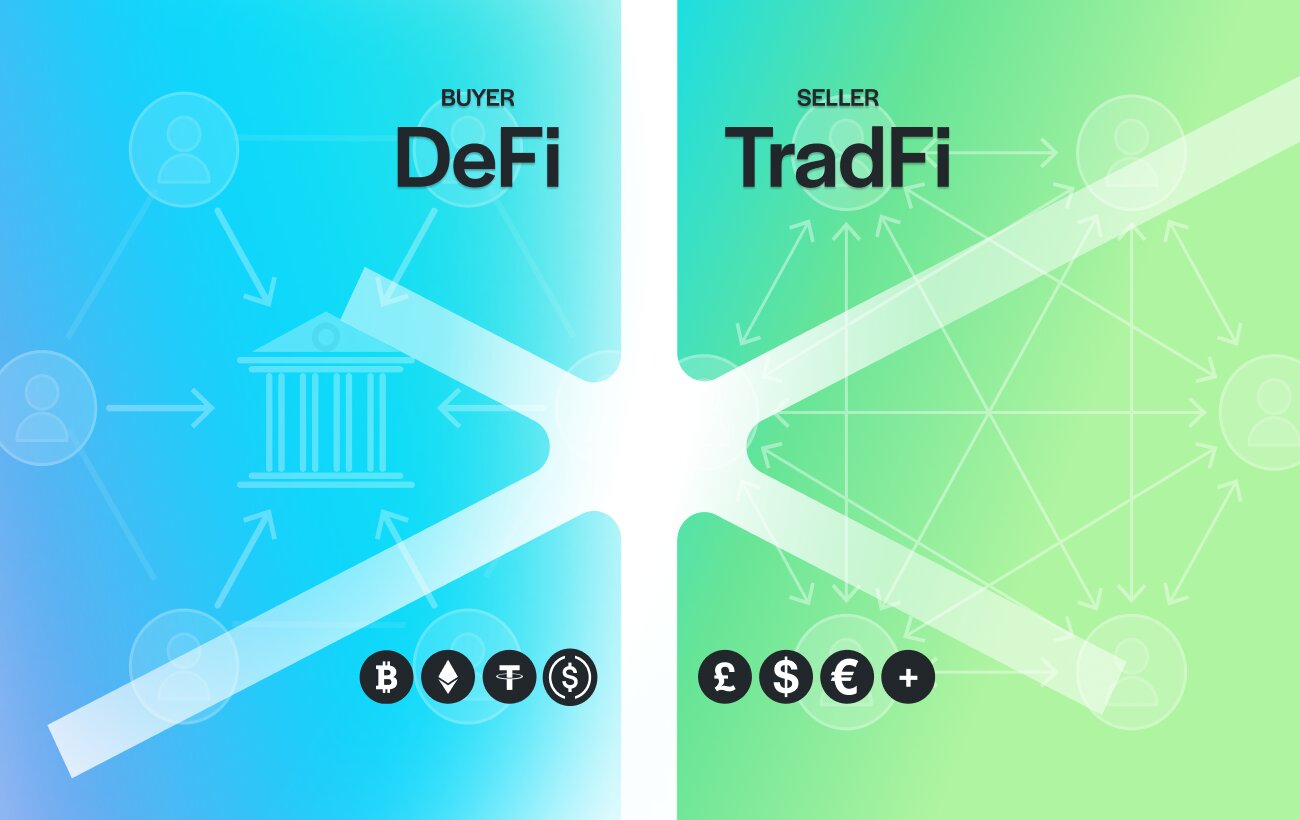

4. The Bridge Between Crypto and Commerce

In fact, the missing piece isn’t demand; it’s a reliable bridge that lets people spend crypto and lets businesses receive fiat, without either side facing complexity or risk.

That’s exactly what TrustLinq delivers.

Here’s how it works:

- The crypto holder tells TrustLinq who to pay.

- TrustLinq converts the crypto (e.g., USDT or USDC) into fiat at the moment of transfer.

- The recipient receives a standard bank transfer (SWIFT, SEPA, or Faster Payments).

No crypto exposure. No volatility. No new systems.

For the business, it looks like any other incoming bank payment.

5. Why Businesses Should Care

Ultimately, avoiding crypto today is like ignoring the internet in the 1990s.

A massive market already exists; high-net-worth individuals, companies, and digital professionals holding and earning in crypto. They’re eager to spend but blocked by outdated banking rules.

With TrustLinq, businesses can:

- Access new customers who pay in crypto but spend in fiat.

- Receive payments seamlessly in their regular bank accounts.

- Operate globally without worrying about currency conversions.

- Stay compliant, backed by Swiss regulation and AML oversight.

6. The Future Isn’t “Crypto vs. Banks” – It’s Both

In short, the real future of payments isn’t about replacing traditional money — it’s about connecting it.

TrustLinq bridges crypto and fiat so they work together.

Less than 1% of businesses accept crypto directly, but nearly all accept bank transfers.

That means crypto holders can now pay 100% of them through TrustLinq.

In Summary

We’re not using crypto for everything yet because the systems around it are still catching up.

But with platforms like TrustLinq, the gap is finally closing.

Crypto in. Fiat out.

No banks, no barriers — and one less reason to ask why we don’t use crypto for everything yet.

Because most businesses still depend on banking infrastructure that doesn’t directly support crypto. TrustLinq solves this by converting crypto into fiat payments, so anyone can get paid in their local currency.

Yes. If the recipient accepts a bank transfer — whether via SWIFT, SEPA, or Faster Payments, you can pay them using crypto through TrustLinq. They receive fiat directly into their bank account.

Not when using TrustLinq. Your crypto is converted to fiat at the moment of payment, so the recipient always receives the exact amount, no price swings, no risk.

No. You don’t need a personal or business bank account at all. TrustLinq sends fiat payments on your behalf, directly to the recipient, under Swiss regulatory compliance.

Mainly complexity, compliance uncertainty, and lack of infrastructure. TrustLinq removes all three barriers; businesses receive fiat, crypto holders pay in digital assets, and everyone transacts safely.

Yes. TrustLinq operates under Swiss AML supervision, ensuring every crypto-to-fiat transaction meets Swiss AML and compliance standards.

The gap between crypto and traditional finance is closing fast. As bridges like TrustLinq make payments seamless, crypto will move from being an investment to a practical, everyday spending tool.

Ready to use your crypto for real-world payments?

You can register once and choose whether you are signing up as an individual or a company.